Thriving Life Sciences Sector Demands Strategic Real Estate

By Peter Conte and Mark Stratz

The arrival of COVID-19 on American soil didn’t spark interest in the life sciences sector, but it has certainly helped fuel it in recent months. Today, the world views biotechnology, drug discovery, pharmaceuticals, health data management, medical devices, and biomedical technologies through a very different lens than it did in the past.

For years, healthcare providers, research institutions, government entities, and private businesses have been focused on more effective and economical ways to translate new ideas into products that can be used to treat patients. Oftentimes, however, inefficiencies inherent in the coordination of efforts among these parties have hindered results. Increasingly, life sciences constituents recognized that technological innovations, supply chain expertise, and real estate knowledge all play critical roles in the research and development, production, and delivery of new medicines and treatments to a global population.

THE CLUSTER EXPERIMENT

As proven in related industries, collaboration aided by physical connectivity improved overall results in the field of life sciences. Decades ago, genetics labs, biotechnology firms and pharmaceutical companies began to cluster in Boston-Cambridge, the San Francisco Bay Area and San Diego with incredible success. Research in these innovation hubs helped U.S. companies bring drugs to market faster, treat patients more effectively, and distribute products in an efficient, timely manner. According to a report by PwC and the California Life Sciences Association, the state of California alone boasted more than 1,300 treatments in the therapeutic pipeline in 2018.

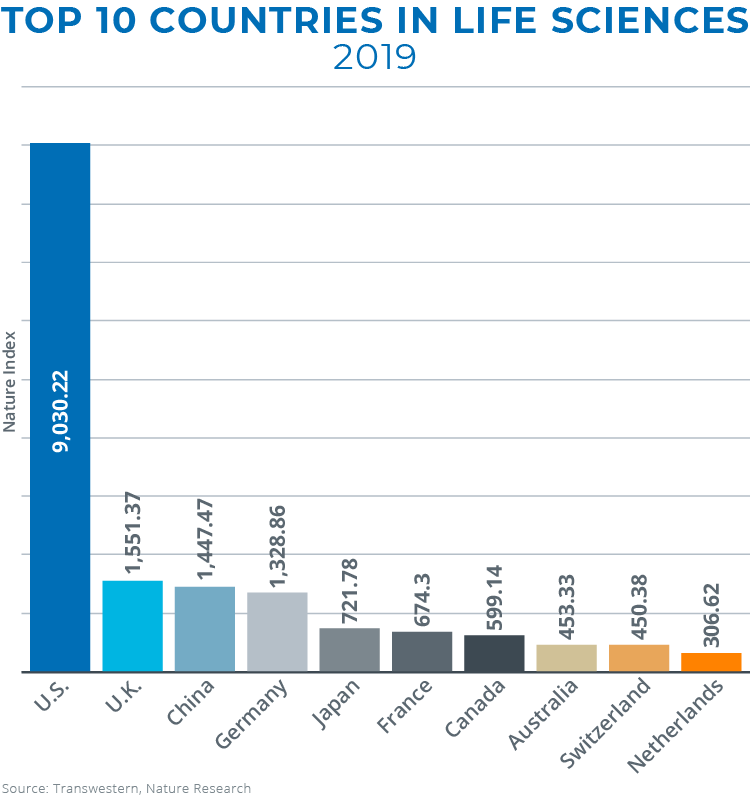

Over time, more organizations tied to the life sciences sector recognized that knowledge sharing thrives – and resources are maximized – in locations that are conducive to natural idea exchange and partnerships that grow organically. Equally important is connectivity to a robust group of research institutions and universities – evidenced by the fact that most current life sciences intellectual property is based on generational work spun out from university projects. As a result, demand for biotech space drove up rents and pushed vacancy rates down in New York-New Jersey and Washington, D.C., as well as more recently in metros such as Houston, Austin, Minneapolis, Denver and Atlanta, to name a few. This rapid growth, and resulting achievements, have helped the U.S. secure the most prominent role in the global life sciences industry.

CAPTURING VENTURE CAPITAL FUNDING

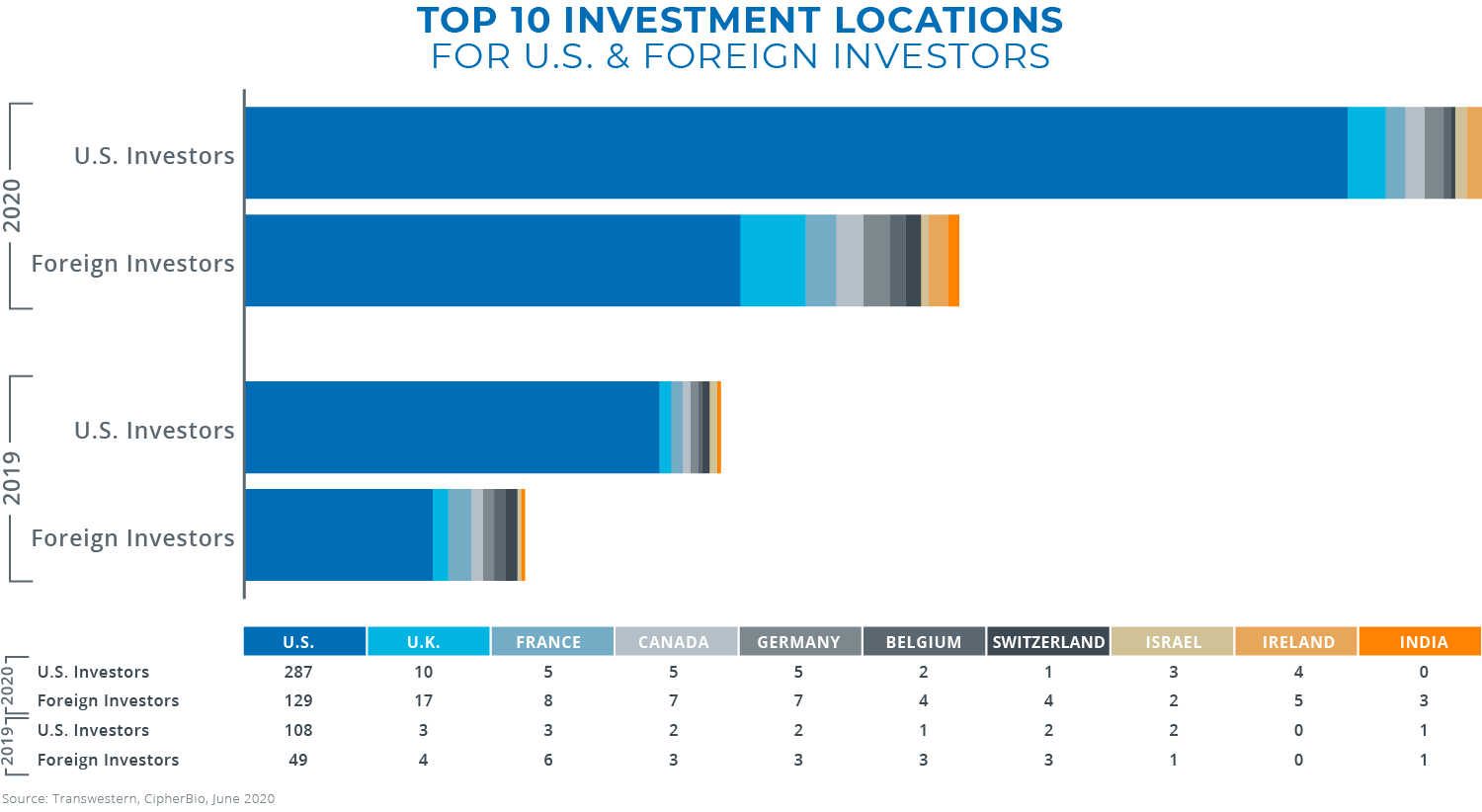

Early on, investors recognized the value of life sciences clusters and ecosystems, and money began flowing into these clusters to fuel the unique needs of life sciences landlords and occupiers. Domestic investors lead this class, with the most deals being in the vertical sectors of biotech, digital health/artificial intelligence, medical devices, and diagnostic, according to data collected by CipherBio. International investors are showing up, too, with this segment being involved in 293 deals since 2019, compared to U.S. investors participating in 468 transactions over the same period.

Even at the height of the COVID-19 pandemic, when the public markets were highly volatile, investment activity did not slow down. In fact, the first quarter of 2020 was the single largest quarter ever for biopharma venture funding in the U.S., totaling $5.5 billion across 171 financings. The average funding size per round – approximately $32 million – was also the largest ever. Forbes reported that of the 19 deals greater than $100 million completed in the first quarter of 2020, 10 of them closed in March. That’s a significant amount of funding to be deployed in an environment that is buzzing with innovation and needs space in which to bring ideas to life.

Albeit historically more than half of every life sciences venture capital dollar has been directed to California and Massachusetts, other clusters with the winning combination of capital sources and educational partners stand to benefit. Investors like safe investments, and history shows that the life sciences industry is nearly anticyclical to the general economy. The problems this sector sets out to solve are big – much bigger, in fact, than those being addressed by retail and enterprise technology, which has been a magnet for investment in the past. As a result, there is growing interest from parties who have never operated in the life sciences space but are willing to venture into it and its complex problems given the timelines and returns.

UNIQUE NEEDS, UNIQUE SPACES

After rising to become one of the most active sectors of commercial real estate in the U.S., those with a stake in life sciences are now paying greater attention to the type of buildings and spaces these companies require to work most effectively. Site selection is an important consideration, because life sciences real estate is not simply repurposed space in any office, medical office, or industrial building located in any central business district or suburban office park. Oftentimes, desk space is accompanied by a need for wet and/or dry laboratories, temperature-controlled storage facilities, wet benching, incubation chambers, vivarium or other specialty testing facilities, and safe disposal of hazardous materials. Once an appropriate property is identified, workplace design can ensure adequate collaboration space and a workflow to maximize efficiencies, while flexible real estate financing solutions can help an occupier adjust for future growth.

When it comes to the surrounding area, life sciences companies typically employ workers who are highly educated and well-paid, and who expect the high-end amenities to which general office users have now become accustomed. This includes access to public transportation, restaurants, retail and entertainment options. An innovation hub modeled after those established in many U.S. metros can position like-minded firms alongside each other and encourage their engagement in the broader ecosystem. Obsolete industrial buildings or even big-box retail centers situated close to educational institutions in vibrant markets provide an excellent canvass upon which to build innovation clusters that benefit from nearby talent and offer a high quality of life, assuming zoning allows for this use.

Municipality partnership is vital, as land use, supply chain logistics, potential incentives and considerations for how such a cluster would alter a submarket must be considered. Once this effort is underway, it can attract entities that may have previously only considered locating in larger life sciences markets.

RESPONDING TO SPACE DEMANDS

Due in large part to work that has been done over decades, the U.S. life sciences sector has a solid foundation and a successful track record. Collaboration and coordination of efforts have enabled a rapid R&D response to the current pandemic. At the same time, this industry of innovators more than ever before needs partners that can think creatively, anticipate challenges, act on opportunities and navigate a complex regulatory environment. In short, we must thoughtfully prepare for what comes next – because for the industry to mature and accelerate, future capacity must be met.

Commercial real estate is the backbone of this endeavor to provide newly constructed space that meets the myriad demands of the life sciences industry. For example, the Global Health Crisis Coordination Center in Atlanta is an innovation district designed to foster collaboration in healthcare and life sciences and mobilize private sector response to assist the public sector in times of crisis. Genesis South San Francisco is a three-tower biotech hub that will offer high-quality amenities within a bustling life science campus. In Houston, the efforts around TMC3 and The Ion are adding significantly to the type of built environment that supports success across these industries. And in Phoenix, the Wexford Science + Technologies Phase I Phoenix Biomedical Campus is anchored by Arizona State University, which has been named the most innovative school in America for the fifth consecutive year.

Communities that embrace a global mindset can bolster progress, as many life sciences activities are highly interdependent on global collaboration. And of course, in life sciences, close connectivity to the manufacturing sector and the facilities in which they operate is necessary to ensure the goals of these firms are realized.

______________________________________________________________________________

Peter Conte is an SVP at Transwestern, a commercial real estate firm. He uses his background with the USDA and cancer research to lead the Bay Area life sciences real estate team.

Mark Stratz is an SVP at Transwestern and leads the company’s Phoenix office, specializing in office and laboratory real estate for both existing and ground-up developments.